THE 3 BIGGEST INSURANCE GAPS THAT COULD COST YOU AFTER A WILDFIRE

Are You Fully Covered? The Gaps in Your Home Insurance That Could Cost You

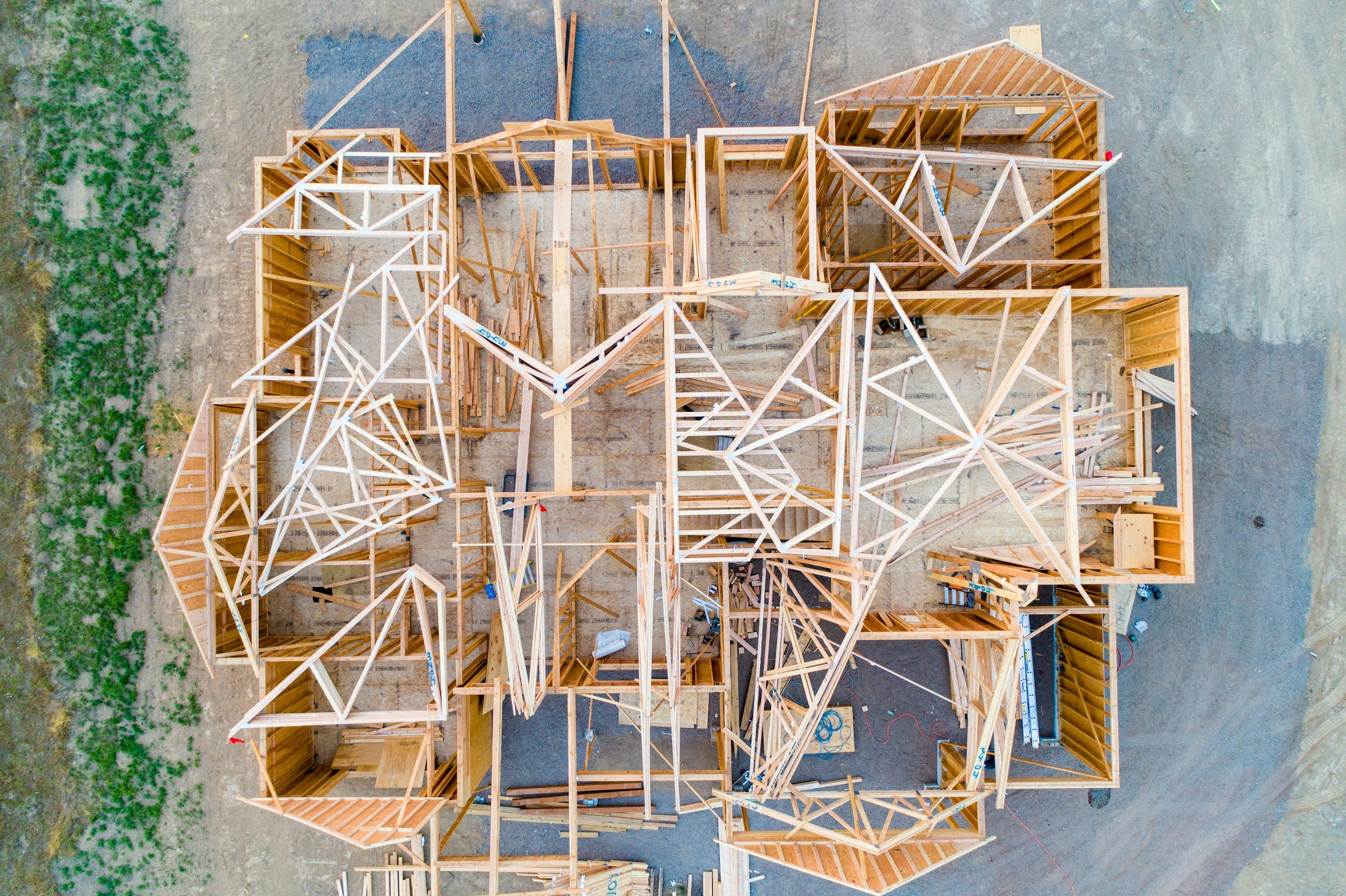

The recent fires in Altadena and Pacific Palisades have left many homeowners facing a harsh reality: their insurance policies might not provide the coverage they actually need. Too often, policies are based on outdated valuations

ACT FAST ON THE CLAIM

We are in the midst of what might be one of the largest tragedies for Los Angeles in our lifetimes. The loss and pain are not only raw but growing day by day as the fires continue. It may seem too soon to think about rebuilding, but we must protect our future—our ability to rebuild—by reacting quickly.

How to Navigate Your Insurance Policy After a Loss

In the wake of devastating wildfires, one of the most common questions homeowners ask is: How do I read and understand my insurance policy? Whether you're facing a total loss or a partial loss, or just smoke damage, the process of interpreting your coverage can be daunting. Here’s some basics.

Documenting Your “Total Loss”

If your house is completely burned down and is clearly a total loss, your insurance company will still need to document the cost to rebuild it. In some states, a total loss leads to a simple maximum payout of your policy, but this is not the case in California.